If you’re like us, you’re used to budgeting for monthly bills and long-term items like a home and retirement. But have you created a financial plan for healthcare costs?

Health impacts every area of women’s lives, but budgeting for it is often an afterthought. Most Americans wouldn’t be able to cover an unexpected $500 medical expense without borrowing money or using a credit card, and medical debt is the leading cause for personal bankruptcy in the US. On average, women spend 6.8% of their income on healthcare, but that figure varies widely based on individual income levels and health needs.

While it’s impossible to predict when a medical emergency will occur, stashing away money is a prudent way to mitigate the financial impact of impending healthcare expenses. And for women who want to start families one day, it’s never too early to start thinking about and saving for that phase of life.

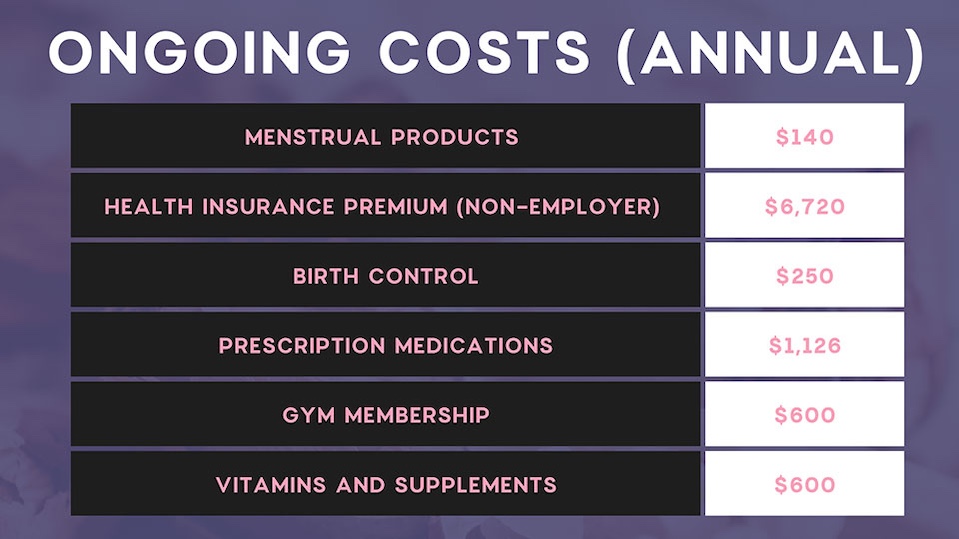

We strongly encourage you to work with a financial advisor to determine a budget that supports your short and long-term goals. To help with the planning process, we’re highlighting some of the most common healthcare costs for women. This list isn’t exhaustive, but it’s a great starting point for creating a healthcare budget.

Actual costs will vary based on location, insurance coverage, and individual health conditions. Use it as a guide and do your own research to come up with realistic estimates for your situation.

We recommend everyone take time to explore their options for paying for and offsetting healthcare costs. If you work for an employer who offers coverage, consider attending an information session during open enrollment or setting up time with your Benefits Administrator to get an understanding of your benefits. Determine whether your policy is eligible for a Flex Spending Account (FSA) or Health Savings Account (HSA) and if your company offers a match. An FSA or HSA is a great way to lower your tax burden while saving for healthcare costs.

If you need to purchase private insurance, visit the US government’s official site to determine if you’re eligible for coverage through Medicaid or to find private plans. And for everyone who’s taking advantage of remote work by traveling abroad, you have coverage options while you’re away from home. Review your credit’s card benefits policy (many offer emergency healthcare coverage) and look into obtaining a travel insurance policy for the countries you plan to visit.

Paying for healthcare isn’t fun, but maintaining good health doesn’t always have to break the bank. The earlier you can plan and save for medical expenses, the easier it’ll be to navigate unexpected setbacks and optimize your treatment options.